In a country where financial literacy remains one of the biggest hurdles for the middle class, a small-town entrepreneur’s personal experience has sparked the creation of a movement. Badi Bahen, India’s first trust-first financial planning platform in various Indian languages, is emerging as a unique solution to help families secure their future.

Unlike most financial apps, Badi Bahen follows a fee-only model — families pay only after seeing actual growth in their net worth. This approach, Saha says, removes the bias of commissions and ensures advice remains truly client-first.

The platform also provides financial guidance in various Indian languages to make concepts accessible, and uses habit-building tools to turn financial literacy into everyday practice.

“Our goal is to simplify finance so much that even a first-time saver can feel confident,” he adds.

Unlike most financial apps, Badi Bahen follows a fee-only model — families pay only after seeing actual growth in their net worth. This approach, Saha says, removes the bias of commissions and ensures advice remains truly client-first.

The platform also provides financial guidance in various Indian languages to make concepts accessible, and uses habit-building tools to turn financial literacy into everyday practice.

“Our goal is to simplify finance so much that even a first-time saver can feel confident,” he adds.

A Daughter’s Request That Changed Everything

For founder Ranadeep Saha, the turning point came in 2021 when his young daughter Anushka asked him for ₹100, saying, “Papa, mujhe 100 rupaye do… main humare liye ek bada ghar banaungi.” The innocent request made him pause. Despite years of running businesses, he realized he had no structured financial plan for his own family. “That question forced me to reflect on what kind of future I was really building,” he recalls. The realization was clear — if someone like him struggled with planning, countless middle-class families across India faced the same challenge.The Financial Planning Gap

Saha’s journey into financial education revealed how deeply the middle class suffers from systemic issues: mis-sold insurance, chit funds, and commission-driven schemes. Even well-educated professionals earning steady salaries lacked proper financial planning. “The problem is not just income levels. It is trust and awareness. People don’t understand the products, and those selling them often have incentives misaligned with families’ needs,” Saha explains. This insight led to the foundation of Badi Bahen, a platform designed to act like the elder sister every family can rely on — explaining money matters in various Indian languages, offering unbiased advice, and building lifelong financial habits.What Makes Badi Bahen Different

Unlike most financial apps, Badi Bahen follows a fee-only model — families pay only after seeing actual growth in their net worth. This approach, Saha says, removes the bias of commissions and ensures advice remains truly client-first.

The platform also provides financial guidance in various Indian languages to make concepts accessible, and uses habit-building tools to turn financial literacy into everyday practice.

“Our goal is to simplify finance so much that even a first-time saver can feel confident,” he adds.

Unlike most financial apps, Badi Bahen follows a fee-only model — families pay only after seeing actual growth in their net worth. This approach, Saha says, removes the bias of commissions and ensures advice remains truly client-first.

The platform also provides financial guidance in various Indian languages to make concepts accessible, and uses habit-building tools to turn financial literacy into everyday practice.

“Our goal is to simplify finance so much that even a first-time saver can feel confident,” he adds.

Awareness Through Storytelling

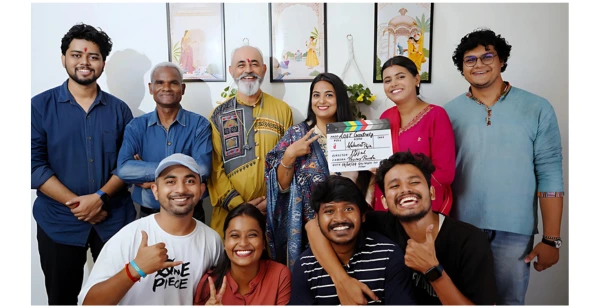

To take financial education beyond classrooms and jargon, the startup has also developed Salahkar Didi, a 100-episode YouTube series that blends storytelling with practical advice. Created in collaboration with Lost Creativity, Jamshedpur, the series will begin streaming this Diwali, October 21, airing five days a week. It is being pitched as India’s first story-driven financial awareness show, designed to engage families in relatable ways.A Broader Social Vision

Beyond financial literacy, Badi Bahen has set ambitious goals:-

- Job Creation for Women – Training and employing 10,000 women as financial guides within the next 15 years.

-

- Mass Inclusion – Bringing financial security to 12.5 crore middle-class families by 2040.

-

- Cultural Shift – Moving Indian households from commission-based advice to trust-first guidance.

View this post on Instagram

Overcoming Personal Struggles

Saha’s journey to becoming a financial planner wasn’t easy. Coming from a small town with limited resources, he had to restart his academic life after more than two decades. Yet, his determination paid off.-

- He cleared NISM XA and NISM XB in his very first attempt — certifications with less than a 50% passing record.

-

- He went on to clear all four levels of the Certified Financial Planner (CFP) program — Level 1, Level 2, Level 3, and the Final exam — in just four consecutive months (Jan–Apr 2025).

-

- Remarkably, he achieved all this after a 21-year gap from formal studies, proving not only resilience but also the ability to master some of the most complex financial planning concepts in a short span of time.

Looking Ahead

With its unique mix of guidance in various Indian languages, unbiased financial planning, and social empowerment, Badi Bahen aims to become a household name for India’s middle class. As the Salahkar Didi series prepares for launch, and with an ambitious roadmap of reaching millions of families, the startup positions itself as more than a platform — it hopes to be the guiding voice of financial security in India’s homes. Because sometimes, as Saha’s story shows, a daughter’s ₹100 request can spark a revolution in how an entire nation thinks about money.Badi Bahen – Key Links & Contact

-

- Website: badibahen.in

-

- YouTube: Salahkar Didi

-

- Instagram: @salahkardidi

-

- LinkedIn: Ranadeep Saha

-

- Contact: admin@badibahen.in