Denial of ITC under Section 16(2)(c): The Most Critical GST Challenge Impacting Businesses Today

By Abhishek Goyal

The introduction of Goods and Services Tax (GST) in India marked a transformational shift in the indirect taxation system. Built on the principle of seamless credit flow, GST was designed to eliminate cascading taxes and promote transparency. However, nearly a decade into its implementation, one issue continues to disturb businesses across sectors denial of Input Tax Credit (ITC) under Section 16(2)(c) of the CGST Act.

For professionals and taxpayers alike, this has become one of the most debated and litigated provisions in GST law.

Understanding Section 16(2)(c)

Section 16 lays down the conditions for availing ITC. Clause (c) specifically provides that a registered person is eligible for ITC only if the tax charged in respect of such supply has been actually paid to the Government by the supplier.

On paper, this condition appears logical. The Government intends to ensure that credit is granted only when tax reaches the exchequer. It may be noted that there has been similar provisions in some state VAT laws on the lines of section 16(2)© like Delhi VAT, Haryana VAT, Maharashtra Vat etc. Meaning thereby, that ITC was sought to be allowed only when the corresponding tax reaches the Government.

However, the practical challenge arises when genuine buyers are denied ITC due to non-compliance or default by their suppliers something entirely beyond their control.

The Real Problem: Shifting the Burden to the Recipient

In numerous cases, businesses purchase goods or services from registered suppliers, receive valid tax invoices, make full payment including GST, and comply with return filing requirements. Despite fulfilling these obligations, they receive notices demanding reversal of ITC because the supplier failed to deposit the tax or file returns.

This effectively shifts the compliance burden from the supplier to the recipient.

The critical question is:

Can a bona fide purchaser be penalized for the fault of another taxable person?

This issue strikes at the heart of fairness and ease of doing business.

This has now become the hotly debated and most litigation prone areas of GST since inception.

Judicial Trends and Evolving Interpretation

Indian courts have started examining this issue in depth. Several High Courts have observed that if the purchasing dealer has acted in good faith, possesses valid documentation, and has actually received goods or services, denial of ITC merely because the supplier defaulted may not be justified.

Judicial principles emerging from various rulings suggest that:

- The transaction must be genuine.

- There should be no fraud, collusion, or fake invoicing.

- The recipient must have exercised reasonable due diligence.

- The recipient must be able to prove the bonafides through movement of goods and documentary trail.

However, litigation is ongoing, and there is no final authoritative pronouncement from the Supreme Court conclusively settling the matter. As a result, uncertainty continues to prevail.

Practical Impact on Businesses

The denial of ITC under Section 16(2)(c) has serious financial and operational consequences:

- Working Capital Blockage: Reversal of ITC leads to additional tax outflow along with interest and penalty.

- Vendor Monitoring Pressure: Businesses must constantly track supplier compliance through GSTR-2A and GSTR-2B reconciliation.

- Increased Compliance Costs: Continuous follow-ups, documentation, and audits increase administrative burdens.

- Litigation Exposure: Notices under Sections 73 and 74 are increasingly issued in ITC-related matters.

For MSMEs especially, such reversals can disrupt cash flows significantly.

Risk Mitigation Strategies for Taxpayers

Until legislative clarity emerges, businesses must adopt a proactive approach to safeguard their ITC claims:

- Regular reconciliation of purchase register with GSTR-2B

- Vendor due diligence before onboarding

- Inclusion of indemnity clauses in supplier contracts

- Periodic compliance confirmations from vendors

- Maintaining proof of receipt of goods/services and payment evidence

While these measures do not eliminate risk entirely, they help demonstrate bona fide conduct and strengthen legal defense.

The Need for a Balanced Approach

GST was conceptualized as a self-policing and technology-driven tax regime. If the system already captures supplier defaults digitally, enforcement action should ideally be directed against the defaulting supplier rather than the compliant recipient.

Revenue protection is important, but so is maintaining trust in the system. A balanced interpretation of Section 16(2)(c) is essential to preserve the core objective of seamless credit flow.

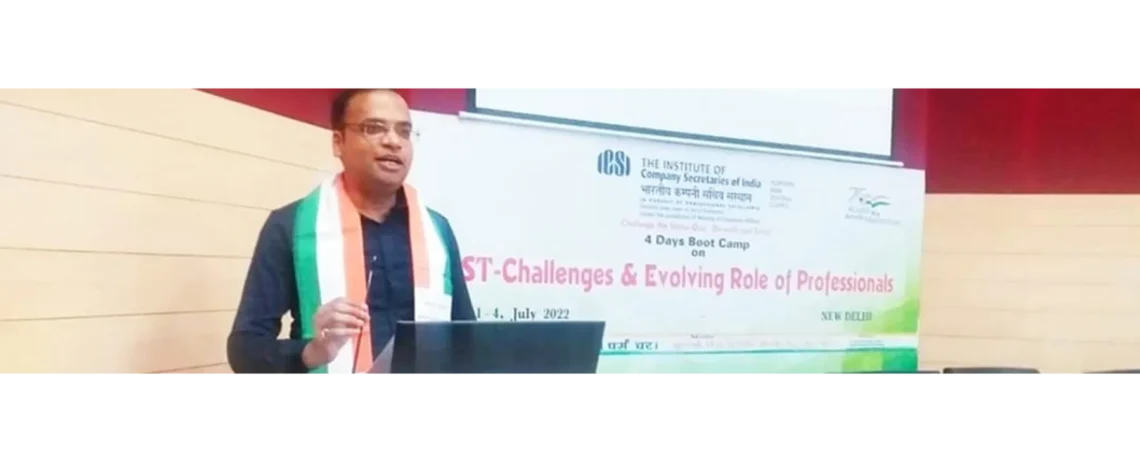

The Professional Behind the Perspective

Abhishek Goyal is a qualified Company Secretary with an LL.B. degree and a Diploma in Corporate Litigation, bringing over 16 years of experience in taxation. His journey in taxation began in 2010, but the introduction of GST sparked a deeper professional interest in understanding and interpreting this evolving law.

After working with a leading law firm for three years, he established his independent practice under Goyal Abhishek & Associates, focusing on GST advisory, litigation, and compliance

A thought leader in the taxation domain, Abhishek is a Life Member of the All India Federation of Tax Practitioners and member of the Chamber of Tax Consultants. His insights on tax laws have been widely recognized, with 27+ published articles featured in leading professional journals such as Corporate Professionals Today, Taxmann.com, Goods and Services Tax Cases, and ICSI Mysore Chapter e-Magazine.

Beyond his professional achievements, he is a prolific author, having penned five books available on all leading digital platforms like Amazon, Flipkart, Google books etc. focusing on personal growth and mindset transformation:. In 2022, he delivered a presentation for NIRC Delhi (ICSI) on “Place of Supply under GST” and is a regular LinkedIn contributor sharing practical GST insights.

His mission is clear — to become one of the leading GST consultants in the country by combining legal expertise with practical business understanding.

With a unique blend of technical expertise, thought leadership, and a passion for knowledge-sharing, Abhishek Goyal continues to make a lasting impact in the fields of taxation, corporate law, and personal development.

For professional GST advisory and updates, connect with:

🌐 Website: http://www.goyalabhishekandassociates.com/home.aspx

🔗 LinkedIn: https://www.linkedin.com/in/abhishek-goyal-8a6954144/